About Us

Malaysia, which holds the 12th position in the World Bank’s Doing Business Report, stands out as a vibrant center for business and investment in Southeast Asia. This report praises Malaysia for its streamlined processes in setting up businesses, obtaining construction permits, and securing electricity connections, all of which are vital for fostering business growth.

However, despite this international acclaim, local startups often struggle to secure funding, primarily due to the absence of well-structured business plans.

Before diving into the specifics of business loans or financing options in Malaysia, let’s first explore the initial steps to launching a business in this dynamic market.

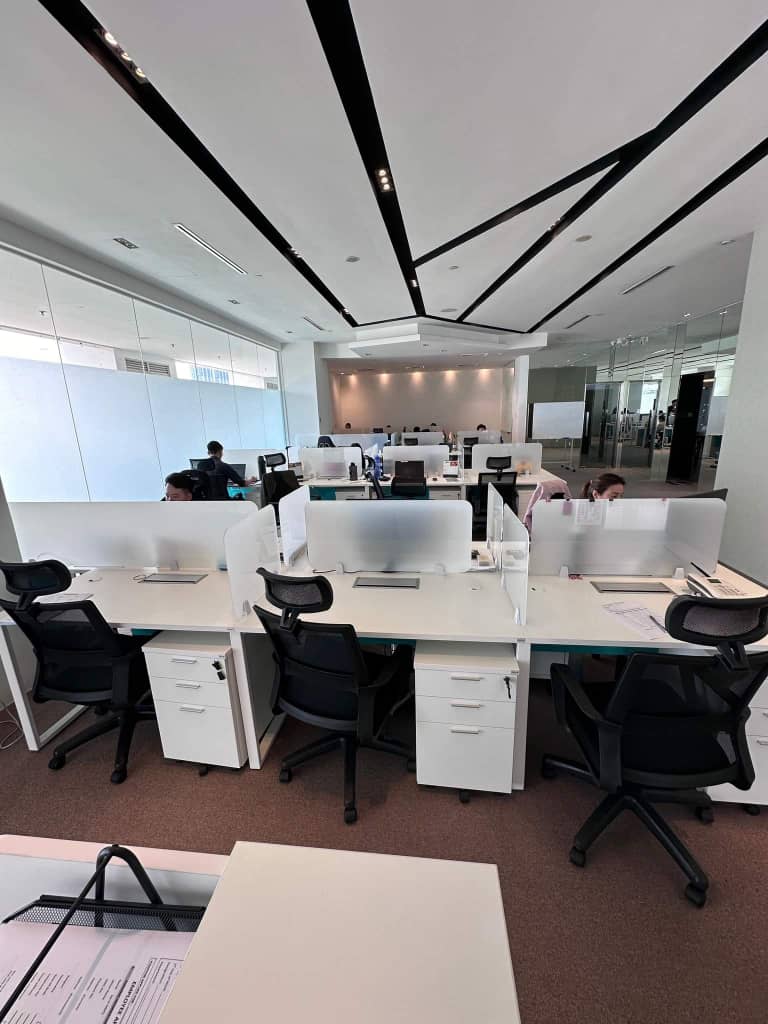

At our firm, we believe in creating a professional and welcoming environment where you can discuss your business financing needs in detail. Our office is designed to provide a comfortable setting for in-depth consultations, ensuring that we understand every aspect of your business. Whether you’re exploring options for a term loan, seeking an overdraft facility, or interested in microfinance solutions, our doors are open. Schedule a visit to meet with our expert consultant, Jasmin U, and explore how we can support your business’s growth and financial health.

Contact us today to book your appointment and take the first step towards securing your business’s future.

Headquarter Office

2-12 & 2-13, The Scott Garden,

Kompleks Rimbun Scott,

289 Jalan Klang Lama,

58200 Kuala Lumpur

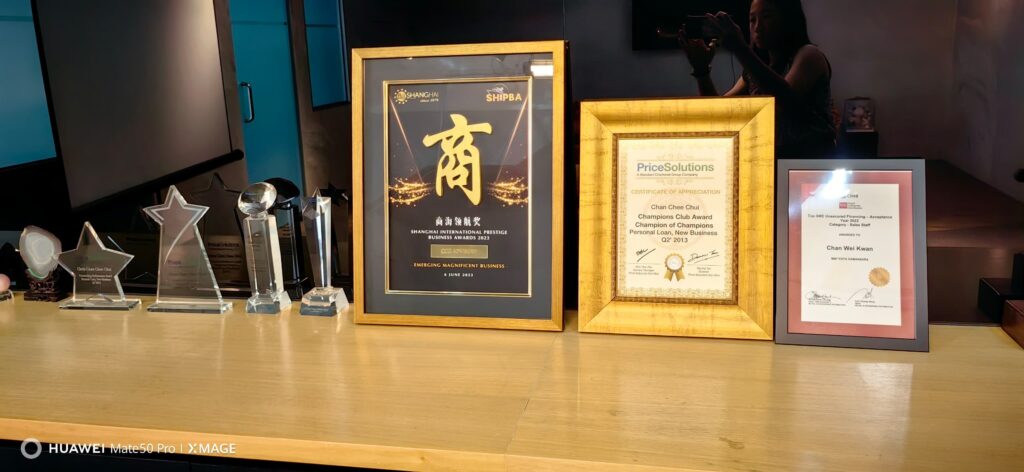

Jasmin U – Expert Business Loan Consultant

With a specialized focus in term loan, overdraft (OD), business tradeline, microfinance/microcredit, and personal loan solutions, Jasmin U has been a cornerstone in the financing industry. Her in-depth knowledge and experience cater specifically to entrepreneurs and businesses looking to navigate the complexities of loan acquisition and financial planning. Whether you’re seeking growth capital, operational liquidity, or strategic financial support, Jasmin is equipped to deliver tailored solutions that meet your unique business needs.

A business loan is a specialized financial product designed specifically for entrepreneurs. While it might seem similar to a personal loan, obtaining one for your business involves a different process.

Initially, when launching a business, entrepreneurs need substantial capital to cover startup costs, capital expenditures, operational expenses, and payments to suppliers. Some business owners start with significant financial resources from investors, personal assets, or savings, making a business loan unnecessary at this early stage.

However, as a business grows and the demand for its products or services increases, additional funding becomes necessary. Instead of depleting personal financial reserves or seeking further investments from private sources, business owners can opt for a loan to support their working capital needs. This approach helps preserve their savings and profits.

Business loans come with specific terms that might be confusing. Below are explanations of some common terms used in business loans:

This is the total amount of sales generated over a specific period, often referred to as “gross revenue” or “income.” It’s a crucial indicator of a business’s overall performance.

This represents the funds available to a business for day-to-day operations.

This term refers to the percentage of a business that is owned by local citizens.

In which a company or business is owned by mostly ethnic Malays.

Big institutions invest their capital to fund startup companies with high growth potential in exchange for an equity stake.

Usually, a high net-worth individual who funds startups at the early stages with their own money, typically in exchange for ownership equity in the company.

Headquarter Office Address: 2-12 & 2-13, The Scott Garden, Kompleks Rimbun Scott, 289 Jalan Klang Lama, 58200 Kuala Lumpur.

Phone:0182261288 0182261288

2024 Jasmin Business Loan Expert | All rights Reserved. Made With ❤ By Pixalink Sdn. Bhd.